Insurance for every stage of life.

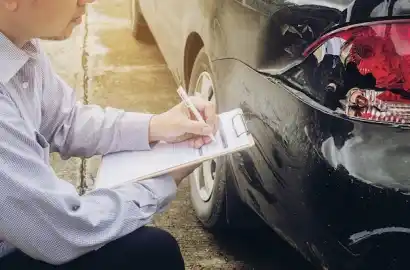

Motor insurance plays a pivotal role in safeguarding vehicle owners against financial liabilities and unforeseen risks associated with driving. With diverse policy options available, including third-party liability, comprehensive coverage, and add-on riders, understanding the intricacies of motor insurance is essential for all vehicle owners. Key considerations include coverage for damage to the insured vehicle, liability towards third parties for bodily injury or property damage, and additional benefits such as roadside assistance and personal accident cover. Evaluating these factors enables vehicle owners to choose a policy that best suits their needs and budgetary constraints. Moreover, comprehending policy terms and conditions, such as deductibles, exclusions, and claim procedures, is crucial for making informed decisions and avoiding potential pitfalls during claims settlement. Regular review and comparison of motor insurance policies allow vehicle owners to stay updated on coverage options and premium rates, ensuring ongoing protection and peace of mind on the road. Seeking guidance from insurance professionals or agents can provide valuable insights and assistance in navigating the complexities of motor insurance and optimizing coverage to meet individual requirements. Ultimately, investing in robust motor insurance coverage offers essential financial security and protection against the risks and uncertainties of vehicle ownership and operation.